This firm was founded on the belief that working with us is more than simply hiring an attorney, it should bring you peace of mind and allow you to continue with your life while we attend to your legal matters. We offer the flexibility of experience that allows us to excel in both aggressively representing your interests or reaching amicable resolutions borne of a collaborative approach, dependent upon your circumstances.

Our firm is full service. We offer our experience to you in the following practice areas:

The attorneys at Rivertown Law are available to consult with you in a private setting at a time that is convenient for you. Rather than simply churn out documents for you like many other faceless firms do, we prefer to be a trusted adviser you can turn to for help. Rest assured, we will get your paperwork done, but at our firm you are more than a name — you are a person.

Since 2005, we have helped thousands of individuals from all walks of life, including LGBT families, United States servicemen and women, business owners, and employees from some of the area's largest companies and organizations.

Every client relationship is treated as unique and special. At the beginning of each client relationship, we develop a unique client service plan. We spend the time necessary to understand each client's communication styles and preferences, which enables us to deliver both successful legal results as well as excellent personal service.

We meet our clients during some of the most stressful and trying times in their lives. We understand what is at stake and have dedicated ourselves to helping our clients preserve what they value most. Our ultimate goal is ensuring our clients' well-being—both in the confidence gained from an experienced and knowledgeable legal team, and the comfort offered from a compassionate attorney willing to take the time to navigate you through what is often a complicated and emotional process.

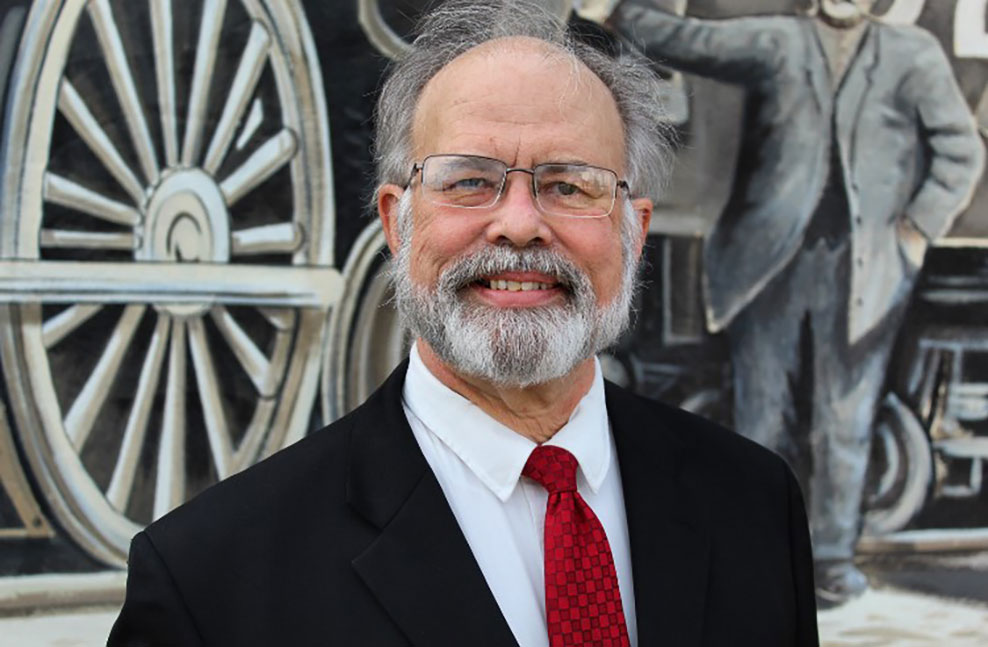

Lead Trial Attorney

In today’s fast-paced world, Terry’s down-home approach will leave you at ease. For the last 43 years, clients with Family Law, Wills, Real Estate, and other litigation needs have gone to Terry to get the right answers quickly. As clients struggle to keep up with changing, local, and state laws, Terry provides concise advice and actionable solutions. He has years of experience litigating hotly contested cases. That background enables him to develop clear terms in negotiations and agreements, all with an eye to avoiding future legal strife. This tactical and business-focused approach resolves highly contentious legal claims for a fraction of the cost.

In his free time, you will find him working on or riding his tractor around the farm with, Scruffie, his dog.

Founding Attorney

After traveling the world and the seven seas, Brad came home, founding Rivertown Law in 2005. Since then, he has guided Family Law, Real Estate, Criminal and Personal injury clients through good and bad times, giving timely advice and actionable solutions. Over the last 17 plus years he has litigated hotly contested cases in both Federal and State courts. That background has enabled him to develop a clear vision, a vision he uses during negotiations and trial work. All with an eye towards avoiding future legal trouble. This tactical and focused approach resolves highly contentious legal claims for a fraction of the cost.

Brad is a master of useless trivia, and in his free time he enjoys watching SCFI with his dogs Roxie and Daisy.

Lead Real Estate & Probate Attorney

Born in Washington DC John developed a love of paperwork at a young age. And as they say, “do what you love, and you will never work a day in your life”. Well John has done just that over the last 33 years. Over the last three decades John has helped several local governments develop zoning laws, ordinances and landowners fight those same laws. When not fighting zoning laws he helps home buyers and sellers navigate an ever-changing housing market. Over the last 20 years John has supported families through all areas of life, and death, helping with Wills and Probate issues.

John and his dog, Atlas are lifelong Cubs Fans. And Atlas assures John that next year will be the year the Cubs win the World Series.

Phasellus feugiat massa sed elit fringilla malesuada. Nunc justo magna, porta vitae vestibulum non, aliquam eu orci. Sed molestie elit euismod, euismod eros maximus.

843.488.5600

Let us help you

Everyone has a story to tell. For over 15 years, our firm has established a legacy of success in navigating our clients through some of life's most difficult challenges. Let us help you.